Despite EM and AxJ portfolio managers praising Asia’s stronger reserve balance, covered foreign currency exposure, leading growth rates and political stability, there are still some who would panic on the withdrawal of liquidity from the Fed and ECB – the authorities who controls the supply of USD and EUR that are the most internationalised currencies. The outflow of EM Asian currencies from local markets is hurting those with uncovered foreign currency exposures as it devalues.

Here, “internationalised” means that the currency is able to be issued offshore, by non-residents or residents, or by non-residents in either on or off shore, or its domestic debt or asset market is opened to non-residents investment.

Amid an exodus from emerging markets, investors are pulling out of even Asian economies with solid prospects for growth and debt financing.

With the market underpricing the Fed’s median forecast for FF rates, and the Fed still 2/3 its ways of fully pricing in its terminal rate, this episode of panic either signals a healthy adjustment from Asian EM investors allocation or the less likely scenario that Asian EM economies are deeply intrenched into US monetary policies with the frivolous issuance of foreign currency debt to finance its growth.

Doing some research on how the “Original Sin” came to form led me to a well written 2010 old research paper from BIS.

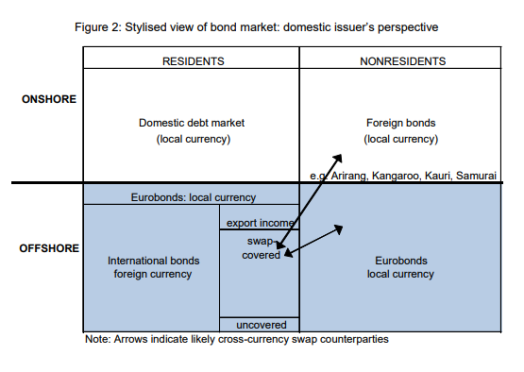

Below, making heavy reference to the BIS paper “Why issue bonds offshore?”, I summarise the motivation for offshore bond issuance and explore the concerns of both investors and borrowers leading them to make a decision to operate onshore or offshore.

Bond Market: From Issuer’s perspective

Offshore debt issuance by residents:

- local currency bond (Eurobond)

- foreign currency (International bonds) to be …

- naturally hedged against export income

- swapped covered into local currency. CCBS counterparties willing to exchange local currency for foreign currency would be non-residents who have issued in local currency onshore but vice versa, need the foreign currency. Note: Bilateral exchange are possible when they are mutually beneficial.

- uncovered – exposed to foreign exchange risk

Note: Foreign currency issuance are mostly done offshore. Typically, they are swapped covered to reduce foreign exchange risk.

The share of Eurobonds (offshore issued local currency) is low across APAC, with the exception of Japan – Japan borrows Yen directly from non-residents in the offshore market (EuroYen bond) as well as substantially from non-residents in the domestic debt market (Samurai bonds).

The substantial holdings of Yen-denominated bonds by non-Japanese companies operating onshore is something only MOF Japan can pull off, keeping them safe from committing the “Original Sin” – committed when a country’s domestic currency is not marketable and the country face difficulty in borrowing abroad or even domestically in local currency. Once the sin is committed, the country will be susceptible to the whims of the international currency they used to issue their bonds as there will come a point in time when they have to repay their debt in the issued foreign currency, yet not having autonomy over the foreign currency value over its local currency. Credibility of a currency and thus its marketability is hence crucial to avoid committing a sin.

Onshore debt issuance by anyone is entirely in local currency. In this case, if local currency debt issued onshore by non-residents, they will be foreign bonds in the domestic debt market. For instance, a Samurai bond is a yen-denominated bond issued in Japan by non-Japanese companies, and is subject to Japanese regulations. These bonds provide the issuer with an access to Japanese capital, which can be used for local investments or for financing operations outside Japan.

One might ask, why did Japan kept its interest rate low relatively to its peers while having a high debt to GDP ratio? State-backed Japan Bank for International Cooperation (JBIC) wants to boost the use of Yen as an international currency. Efforts made to commoditise Yen are occasional courtesy of guarantees of principal repayments supplied by JBIC (i.e. JBIC acts as a guarantor for anyone who borrows in Yen), enabled the sale of samurai bonds to a wide range of lower-rated developing countries (e.g. Turkey can issue Samurai bonds, borrow Yen, so long if it can offer a yield a few points above the benchmark yen swap rate), kept its credibility of maintaining a low financing cost (i.e. no misleading or playing games with their guidance or promises they made). US issuers are responsible for about a third of the outstanding samurai paper. The catch to US issuers is that issuing Euroyen bonds and swapping it back to USD is still cheaper than issuing USD-denominated bonds. However, tax authorities in Japan and the US were unable to resolve their differences. Under a change in US law, US Samurai issuers will no longer be able to deduct their interest costs for newly issued bonds, while Samurai investors will be subject to a 30 per cent withholding tax on their coupon payments. (Withholding or retention tax, is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income.)

So who would buy bonds issued by low-rated developing countries tapping on a liquid domestic Yen debt market? Given it is onshore and denominated in local currency, the majority of buyers of samurai are financial investors such as life insurance companies and pension funds. To an extent, BOJ is a strict father that sets a near zero benchmark rate and forces its domestic financial companies to lend to any non-resident who needs Yen if they wish to make any profit and survive. Using Turkey as an example, the catch to Japan is that it can dispose Turkish Lira back to Turkey who had issued Samurai bonds and also act as a counterparty to CCBS Yen to its domestic Lira. To an extent, Japan earns both on a slightly higher yield for Samurai as well as paying less on swapping Lira back for Yen since Turkey need Lira more than they do and their currency is more marketable.

In most cases where there isn’t supportive local financials willing to be swap counterparties to non-resident issuers of its local currency, there can be another independent counterparty (e.g. World Bank) who would accept the local currency while exchanging to a currency they need. Otherwise, residents would typically issue local bonds onshore, and non-residents would typically issue local bonds offshore. However, this can only pull off in more open financial systems (HK, JP, SG, NZ) as there need to be supply of domestic currency offshore to satisfy the offshore issuance size. HK has a sizable offshore bond issuance in own currency. In the polar opposite, close financial systems like China and Malaysia has a restricted quota for offshore trading of its local currency.

Vice versa, a high local financing cost is a deterrence to internationalising its local currency. Instead of attracting borrowers to issue debt in cheap-financing currency, countries with a high benchmark deposit rate attracts foreign investors to demand their local currency offshore and lend them their currency onshore by holding their debt, while receiving a high yield like a resident in a domestic debt market.

For instance, in Antipodean countries that are less reliant on imports and more self reliant on its domestic resources and exports, issuance of offshore bonds in USD or EUR and swapping proceeds into local currency as a substitute for issuing domestic currency bonds directly is common as it is cheaper to borrow. That said, most of its foreign currency liability are forward hedged and CCBS covered.

Why issue offshore bonds?

Who have a significant offshore bond issuance? Hong Kong, Singapore, Australia, New Zealand, Philippines. Why?

Risk management (Hedging)

Hedging is likely to be an important motivation for non-financial issuers, especially exporters. Diverting export income in foreign currencies as coupons in foreign currency bonds provide a natural hedge. Foreign currency bonds can be issued in its respective country onshore as a non-resident or issued offshore in the Eurobond market. Notably, the bulk of foreign issuance is done by financial firms, and typically if issued by corporates, they are swapped covered.

Price arbitrage (the job of most cross-border swap traders in financial firms)

Banks often undertake opportunistic swap-covered foreign currency borrowing to lower their funding costs without taking on exchange rate risk. This type of borrowing leads to a convergence of funding costs across markets consistent with covered interest rate parity (CIP) – local and foreign funding costs are equal once the cost of hedging (CCBS spread) is accounted for. Read here to understand how CIP works to plug in and balance the equilibrium and why CCBS spreads ironically persist in a liquid and complete market.

Foreign currency offshore issuance affects…

- local-foreign bond spreads (e.g. Yankee for US bonds) that captures differences in liquidity risk, issuer risk and duration profile,

- CCBS spreads – hedging cost for foreign issuance. Here, having a healthy supply of natural swap counterparties on the other side (non-residents issuing local currency bonds) that’s willing to take the shorter end of the stick and issue at a less favorable yield is crucial for this covered swap operation to pull off. Think of it as a reciprocation where only when you give others your currency, can you take it back in the future. A change in hedging cost in turn affects the decision by both residents and non-residents on where to issue next.

Despite covered issuance being an attractive bargain from a cost perspective, the choice of foreign currency matters from a risk perspective – is the foreign currency offshore market or onshore domestic debt market large enough to absorb the size of issuance? Does the foreign country actively participate in foreign currency issuance as well? If uncovered, where is their foreign exchange risk tilted to? For instance, developing countries issue USD-denominated bonds in the Eurobond market but US itself issues Samurai or Yen-deonominated bonds in Japan’s domestic debt market.

Notably, local currency offshore issuance by non-residents may also respond to cost differences between onshore and offshore markets – if its too cost disadvantageous, they might come in as swap counterparties.

Market completeness

Similar to why China internet companies are forced to list ADRs in the US equities market, ineligibility to issue low-grade debt market in domestic currency, may lead to persistent patterns of cross-border issuance, to maintain equal funding costs across markets. Differences in market characteristics (liquidity, diversity, risk) lead to a relative cost differentials favoring the less risky counterparty. This cost differential is mutually beneficial. Borrowers from less complete markets can lower funding cost (e.g. foreign offshore bond yield + CCBS spread), lenders from more complete markets can fill in the gap and earn higher interest by being swap counterparties with more attractive receive-pay cash flows, or lending their currency offshore to earn the offshore-onshore spread.

Besides chasing favorable return on capital or financing cost, investor preferences for eligible risk profiles (e.g. investors can voluntarily set mandates for fund managers that restrict investments to IG bonds) and borrowers preferences for longer tenors range (e.g. needs funding for long term projects) are concerns that lead to swap-covered offshore borrowing. High risk premium compensation for HY bonds will never be able to attract investors who cannot invest in debts outside their eligible risk profiles. Issuance in Eurobond market expands the pools of savers and borrowers and a better match of preferences would create a more liquid market.

Some of the differences between onshore and offshore markets that may give rise to benefits from issuance in Eurobond markets include:

- Low-grade bonds – While ineligible to issue onshore in the domestic debt market, low-grade borrowers can access Eurobond market for raising funding needs. However, to swap cover the liability, domestic market needs to allow high-grade non-residents to issue foreign bonds onshore so as to be swap counterparts. Typically, emerging economy have high inflation and high interest rate such that budding companies with a short track record are usually not eligible to issue low-grade onshore bond, especially when the country and its currency is still not stable. Even if its possible, expected compensation from investors exposed to a risky company and unstable currency will demand a yield that makes financing unsustainable. Moreover, developed economies will be unlikely to issue EM currency-denominated (foreign) bonds in EM debt market as they can achieve a lower financing cost in their own debt market and need not be exposed to EM currency, inflation and interest risk. With the exception of Japan where their interest is kept lower than other DM, EM with higher interest might not be able to swap cover all their offshore foreign issuance. In this case, EM have to open their economy and trade with DM so that EM central banks are able to accumulate enough foreign reserve to be swap counterparties to local companies seeking attractive financing offshore.

- Longer tenors – The development of longer-term markets may be particularly slow in countries, where investors avoid such investments due to a history of economic uncertainty or the sovereign benchmark yield curve is relatively short. This results in a mismatch of investors and borrowers preferences and hence the need for offshore foreign issuance.

- Fixed-rate bonds – Mismatch of investor preferences leads to ineligibility of low-grade issuers to secure fix rates which would require borrower to issue floating rate and perform a IRS to fix cost for the tenor. If floating rate debt market is more liquid than that for fix rate, or there is a lack of credit grade diversity for fix rate debts, investors would have more uncertainty for fix rate bond issuance resulting in mismatched demand and supply.

- Larger issuance size – Offshore markets have a larger investor base to absorb larger issuance (e.g. Jumbo bonds) thereby fixing a fixed cost for a larger loan. Weak domestic savings and slow growth in the financial industry also slow down the development of a domestic debt market, resulting in residents ussing offshore instead. In the contrary, countries with compulsory retirement savings system boosted the domestic savings pool leading to a reduced offshore issuance, particularly when the country pegs its interest rate to international currencies (USD) domestic interest rates. Viewed as such, offshore issuance appears to be tapping on foreign savings. However, benefits of offshore issuance are also not restricted to countries with current account deficits. A country with no debt may have large gross assets and liabilities. Investors can diversify their balance sheet by holding foreign assets and residents borrowing from non-residents. Besides tapping on foreign savings, countries with current account deficits can offer a higher benchmark interest rate to attract investors funding. This was the approach used by Australia. Data from the Australian Bureau of Statistics indicate that foreign investors own around 20% of bonds issued by Australian non-government residents in the domestic market, and own almost all of bonds issued offshore by Australian residents.

- Exotic bond structures – More complicated bond structures, such as structured bonds with step-up coupons, tend to develop in deep liquid markets before they are available in smaller markets. While more complex bonds are likely to be structured to meet investor preferences, their development may be limited by investors’ financial sophistication (particularly where the bond market investors are predominantly retail), by regulations constraining their use, or by a lack of a legal framework.

- Risk unbundling – Residents buying local currency bonds issued by non-residents in offshore debt market will take on only credit risk without any exchange rate risk. The need for unbundling is preferred by investors more particularly when credit risk rise while currency depreciates. Meeting the investors preferences would lower the expected compensation and their funding cost.

Barriers to non-residents investment onshore

Most of the benefits of covered swap offshore issuance depends on whether is there a willing swap counterparty. Their absence will move hedging cost against issuers and cost incentives will disappear.

Conditions favorable for non-residents to issue foreign bonds offshore are:

- availability of swap counterparties i.e. residents issuing Eurobonds

- access to a developed FX derivatives market for hedging exchange rate risk (e.g. availability of CCBS, FX Forwards of tenors same as issuance)

- no capital and exchange controls or quotas limiting liquidity for local currency offshore or FX derivatives

- currency bond is issued is within currency coverage of the central bank’s guarantee e.g. Korea only covers foreign currency bonds only

- central bank accepting a wide range of eligible collateral in their lending operations (typically repo eligible ones are IG debt in resident’s domestic currency or those under coverage e.g. non-U.S. central banks accepting U.S. debts)

- absence of non-resident withholding tax would prompt banks to use offshore branches to issue foreign bonds to avoid a “approver issuer levy” – 2% charge on value of the security levied on debt exempt from non-resident withholding tax. In Korea, levy is exempted if bond is denominated in foreign currency.

- developed infrastructure in clearing and settlement systems that is internationally compatible

- agencies providing these infrastructure are creditworthy and reliable counterparties

- supportive legal environment (e.g. bankruptcy proceedings, corporate governance transparency, accounting standards), diversified market participants and security ownership

- Likewise favorable treatment from other central banks to non-resident’s issuance such that it is repo eligible in other countries beyond onshore

In principle, investors could hedge the risks in issuers’ desired funding, rather than issuers transforming the risk characteristics of their funding (swap cover foreign currency). However, most issuers are banks and are regular authorised participants in wholesale derivatives markets and typically deal in larger amounts than investors, hence its more cost efficient for issuers to transform their funding characteristics. And if issuers choose not to transform, they will have to meet higher compensation demanded from investors.

Since the Asian crisis, non-residents have increasingly been allowed to participate as investors in regional markets as regulatory barriers wind down, while residents are encouraged to save to develop their domestic debt market. Increasing foreign ownership of domestic debt allows the faster growth of the domestic debt market by tapping on foreign savings and broaden its risk profile diversity (e.g. a domestic debt market with only local investors will be more fragile when domestic economy does badly). This in turn internationalise the country’s currency and correlates domestic growth with the world, while increasing the availability of swap counterparties.

Funding diversification

Financial institutions issues bonds in offshore markets to diversify their funding base will also diversify the currencies raised. That said, they would favor bonds in currencies where they are widely repo eligible. With a diversified funding base, they are able to access other markets when one market is closed (Asia-UK-US sessions). An exception was pre-GFC. No one could imagine illiquidity in the US bond market, the most internationalise currency and debt widely repo eligible across many legal jurisdictions.

The use of offshore currency, tightening liquidity from slower trade rotations, and possible deleveraging needs for offshore USD as deficits targeted to shrink

https://blog.jpmorganinstitutional.com/2018/05/examining-offshore-dollar-liquidity-in-light-of-the-three-phases-model/

Rexaming Balance Of Payment, rotation of currency for cross border trades, manipulation of BoP by central bank’s intervention, offshore supply a outcome of BoP deficit

https://blog.jpmorganinstitutional.com/2015/09/cross-border-capital-flows-a-refresher-on-the-lingo/

LikeLike